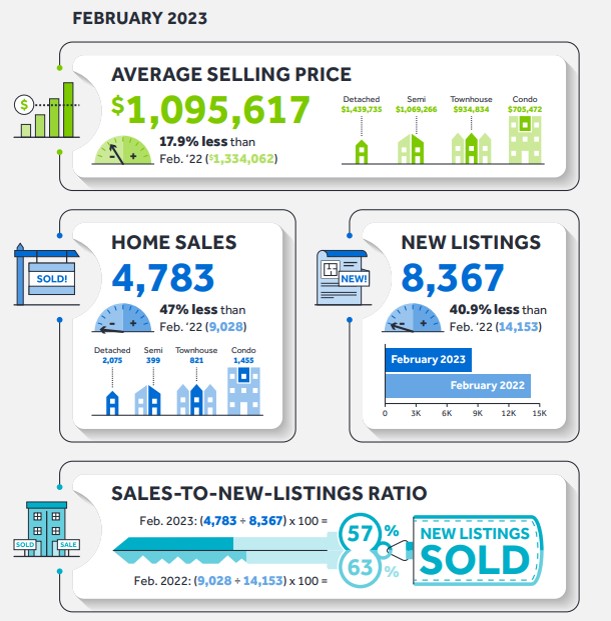

The real estate market in the Greater Toronto Area (GTA) has experienced a significant decline in sales in February 2023 compared to February 2022, before the Bank of Canada started raising interest rates. The number of new listings also dropped substantially year-over-year, which caused the average selling price and MLS® HPI to level off after trending lower through the spring and summer of last year. Many homebuyers have decided to purchase a lower-priced home to offset the higher borrowing costs.

The share of home purchases below one million dollars has increased substantially compared to the same time last year. The Ipsos polling suggests that buying intentions have picked up for 2023, which will eventually lead to renewed price growth in many segments of the market. The constrained supply of listings will lead to increased competition between buyers. The average selling price for February 2023 was $1,095,617, down 17.9% compared to February 2022.

The share of sales below $1,000,000 was 57% in February 2023 compared to 38% a year earlier. The MLS® Home Price Index (HPI) Composite Benchmark was down year-over-year by a similar annual rate of 17.7%, but was up on a monthly basis. Housing supply will be front and center in the policy debate as the June mayoral by-election in Toronto approaches. New and innovative solutions are needed to achieve an adequate and diverse housing supply that will support record population growth in the years to come. The City of Toronto’s initiative to allow duplexes, triplexes, and fourplexes in all neighborhoods citywide is one such solution.

Be the first to comment